From 31st July 2023, the FCA’s new rules and guidance will come into effect in the UK. The primary purpose of the new regulation is to improve the standards of conduct for firms operating in the finance industry ensuring increased consumer care and protection.

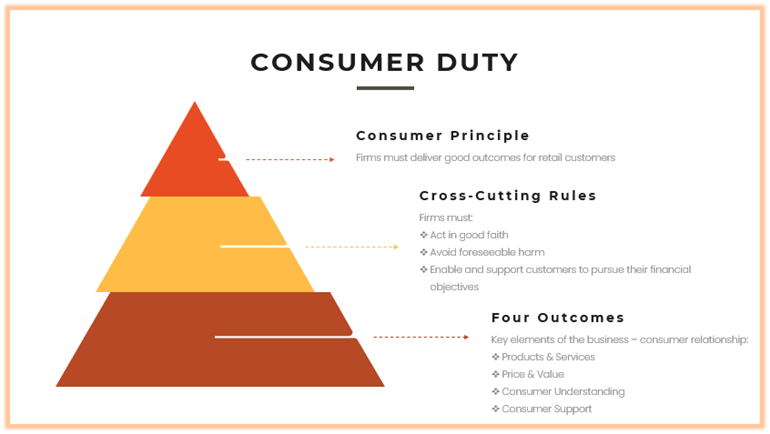

The framework comprises of the following 3 core measures:

- A new Consumer Principle (Principle 12)

- A set of three overarching requirements, known as Cross-Cutting rules which strengthen the standards of conduct that they expect under the Consumer Principle

- Four Outcomes which are a set of rules and guidance providing detailed expectations for a firm’s conduct in 4 key areas of their customer relationships.

Cross-Cutting Rules

Act in Good Faith: Firms must consistently act honestly, fairly and openly with the reasonable expectations of consumers.

Avoid Foreseeable Harm: Firms should take measures to prevent foreseeable harm, such as subpar product or service performance due to insufficient marketing testing, and customers facing excessive charges resulting from misunderstandings about the product or inherent flaws in the pricing structure.

Enable Customers to Pursue Their Financial Objectives: Firms must empower retail customers to make good choices and act in their own best interests by providing clear information and support throughout the lifecycle of the product.

Four Outcomes

Products & Services: The available products and services must be fit for purpose, meeting the needs of consumers in the target market and work as expected.

Price & Value: Products and services should be sold at a price that reflects their value. Excessive fees should not be in place.

Consumer Understanding: Clear, understandable information is readily available at the right time to ensure that consumers are fully informed to make the right decision for them.

Consumer Support: Helpful and accessible customer support should be available to consumers and there should be no barriers to the cancellation or switching of a product or service.

Across the outcomes, there is an expectation that firms review their current approaches to bring them in line with the new Consumer Duty requirements. Firms need to ensure that they can evidence outcomes and review and monitor outcomes on a regular basis. Additionally, any identified issues need to be remedied or mitigated.

Support with Consumer Duty

AuditWise is cloud-based quality monitoring software solution that empowers organisations to evaluate and score the quality of their customer interactions, operations and processes whilst having the ability to identify any compliance issues.

The software serves as a comprehensive toolset to collect, analyse and interpret data related to the varying aspects of quality within an organisation. Outside of the core quality monitoring functionality, the Analytics module enables businesses to identify areas for improvement, recognise trends and make data-driven decisions to enhance overall performance and customer satisfaction. The AgentHub module creates engagement with agents from the outset, offering a transparent dynamic between them and their supervisors allowing bi-directional feedback and comments. Personalised agent dashboards provide full audit history along with any feedback, actions, recognition and awards.

Not sure where to start? Book in a call with one of our Team who will show you the AuditWise platform and advise how it could help you get started with monitoring the new Consumer Duty outcomes for your business: